Learn how to navigate rising mortgage rates and take control—yes, even when mortgage rates are volatile

If you’ve been watching the headlines—or checking your pre-approval status—you’ve probably noticed one thing: mortgage rates are bouncing around like a ping pong ball. One day they dip. The next day, they rise again. That unpredictability can leave you feeling stuck if you’re trying to decide whether now is the right time to buy a home.

But don’t let rate anxiety derail your plans. While you can’t control the ups and downs of the market, you can control key factors that determine the mortgage rate you’ll actually qualify for.

What’s Going on with Mortgage Rates Right Now?

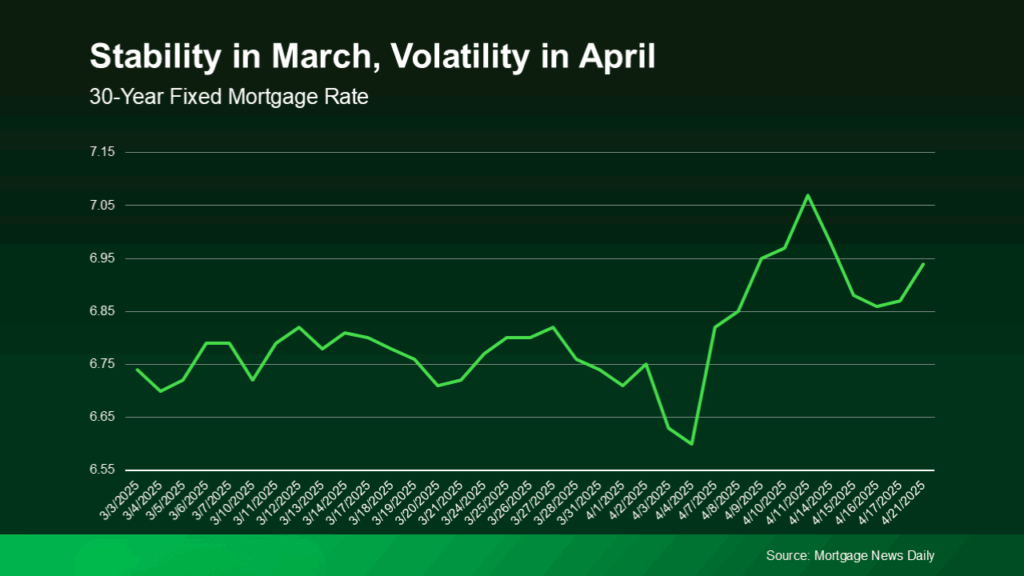

Let’s look at the data. The graph below, based on insights from Mortgage News Daily, shows a steady pattern in March followed by significant rate volatility in April:

This kind of shift is common when economic conditions are changing. Inflation reports, jobs data, and policy decisions all contribute to rate movement. That’s why trying to “time the market” perfectly almost never works.

What You Can Control When Rates Are Unpredictable

You may not be able to change the broader economy, but you can absolutely influence how the market sees you as a borrower. Three major factors affect the interest rate you’re offered:

1. Your Credit Score

A higher credit score almost always means a better mortgage rate. Even a small increase can shave hundreds off your monthly payment.

According to Bankrate:

“Your credit score is one of the most important factors lenders consider when you apply for a mortgage… Typically, the higher your score, the lower the interest rates and better terms you’ll qualify for.”

Want to improve your score? Start by checking for errors, paying bills on time, and reducing credit card debt. If you’re unsure where you stand, ML Mortgage can help you review and optimize your credit profile.

2. Your Loan Type

Different loans come with different terms—and mortgage rates. From FHA to VA to conventional, each loan type has its own eligibility rules and potential rate ranges.

The Consumer Financial Protection Bureau explains:

“Rates can be significantly different depending on what loan type you choose. Talking to multiple lenders can help you better understand all of the options available to you.”

Working with a mortgage advisor ensures you find the best match for your finances and goals.

3. Your Loan Term

A shorter loan term can often mean a lower interest rate, though it may come with a higher monthly payment. On the flip side, a 30-year mortgage might offer easier monthly budgeting, but more interest over time.

As Freddie Mac puts it:

“Your loan term will affect your interest rate, monthly payment, and the total amount of interest you will pay over the life of the loan.”

Your lender can walk you through the pros and cons of each option.

Bottom Line

Yes, the economy is shifting. Yes, mortgage rates are unpredictable right now. But that doesn’t mean you’re out of options. You still have the power to take control of your credit, choose the right loan structure, and set yourself up for success.

At ML Mortgage, we believe informed borrowers make empowered decisions. Let’s find a strategy that works for you—no matter what the market does next.

Ready to Take Control of Your Home Loan?

Let’s talk about how to make today’s mortgage market work in your favor.

Connect with an ML Mortgage advisor and get clarity on your next steps.