With all the uncertainty in today’s economy, it’s no surprise that the stock market has been on a wild ride. One day your 401(k) is booming, and the next it feels like it’s crashing. Watching those constant fluctuations can leave anyone feeling anxious about their financial future—and it’s why more people are comparing real estate vs stocks when thinking about long-term stability.

But if you’re a homeowner—or planning to become one—there’s some good news. Historically, real estate is much less volatile than the stock market. While stocks rise and fall with lightning speed, home values tend to move steadily and predictably. That makes homeownership one of the most stable investments you can make.

Real Estate vs. Stocks: Which Is More Reliable?

According to Investopedia:

“Traditionally, stocks have been far more volatile than real estate. That’s not to say that real estate prices aren’t ever volatile… but stocks are more prone to large value swings.”

In other words, while your retirement portfolio might give you whiplash some weeks, your home’s value likely won’t. That’s a big reason why homeowners tend to feel more secure during uncertain economic times.

A Stock Market Drop Doesn’t Mean a Crash in Home Prices

Let’s look at the data.

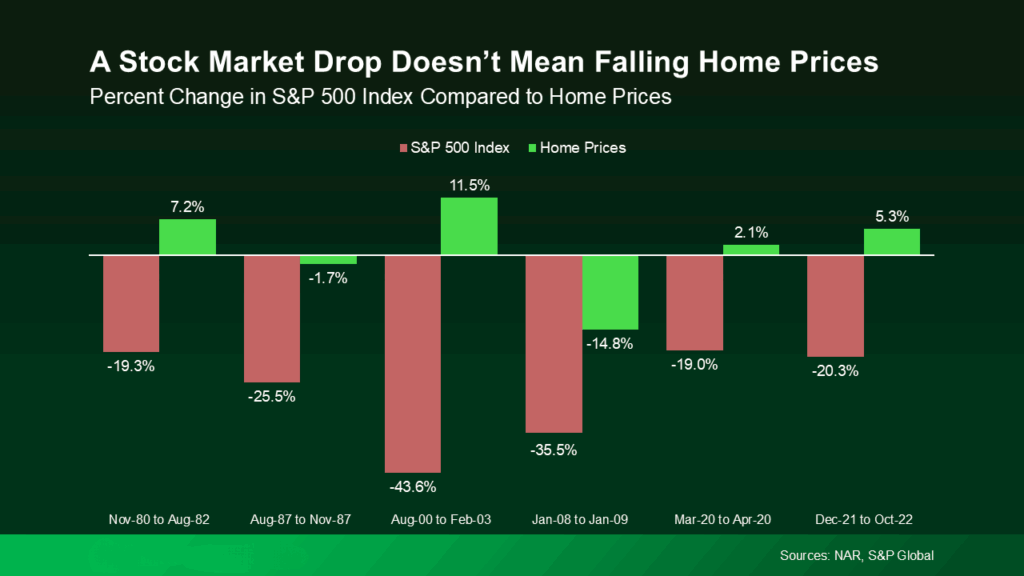

Take a look at the chart below, which compares changes in the S&P 500 Index with changes in U.S. home prices over several key economic downturns:

📉 S&P 500 vs. Home Price Performance (Real Estate Vs Stocks)

- Nov 1980 – Aug 1982: S&P 500 dropped 19.3%, but home prices rose 7.2%

- Aug 1987 – Nov 1987: S&P fell 25.5%, home prices dropped only 1.7%

- Aug 2000 – Feb 2003: S&P plunged 43.6%, while home values climbed 11.5%

- Jan 2008 – Jan 2009: S&P dropped 35.5%, and home prices declined 14.8% (the housing crash exception)

- Mar 2020 – Apr 2020: S&P fell 19%, yet home prices increased 2.1%

- Dec 2021 – Oct 2022: S&P dropped 20.3%, and home prices still rose 5.3%

The 2008 crash was an outlier caused by weak lending standards and a housing oversupply—conditions that aren’t present in today’s market. In most cases, even when stocks dropped sharply, home values remained stable or grew.

Home Prices Don’t Swing Like Stocks

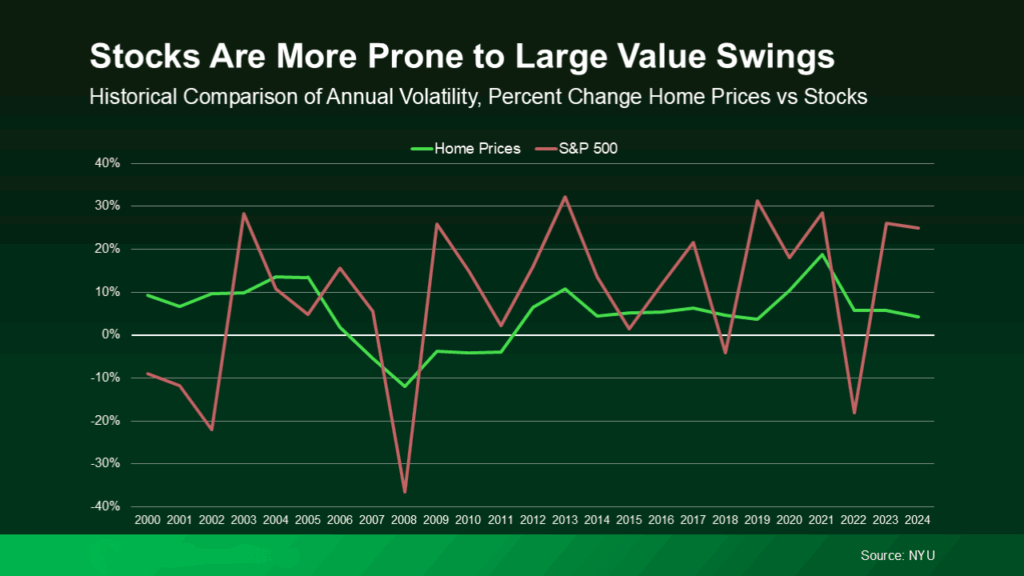

Another key distinction between real estate and the stock market is volatility.

When we compare the annual changes in the S&P 500 to annual changes in home prices over the last two decades, a clear pattern emerges. Stocks are far more reactive. They can spike or plummet by 30% or more in a single year. Home prices, on the other hand, tend to rise or fall more gradually.

This steady pace helps homeowners feel more financially grounded—even when other investments are fluctuating. Real estate values don’t shift dramatically day to day. They move slowly, reflecting long-term trends like local demand, inventory, and affordability.

Why This Matters for You

If you’ve been feeling unsettled after looking at your investment portfolio, remember this: your home is a physical asset with long-term value. It’s not just a place to live—it’s also a financial vehicle that offers stability.

Unlike stocks, real estate:

- Doesn’t react wildly to headlines or economic predictions

- Is supported by tangible value and consistent housing demand

- Grows in equity over time, even if appreciation slows short-term

So if the market has you on edge, take comfort in knowing that your home isn’t likely to experience the same kind of volatility. In fact, it’s probably your most dependable asset.

Bottom Line: Real Estate vs Stocks

Lots of people are feeling nervous about their finances right now. But real estate provides a reassuring contrast to the chaos of the stock market. It offers something stocks often don’t—stability.

Whether you already own a home or you’re thinking about buying, real estate remains one of the smartest, safest long-term investments you can make.

Ready to Talk About Your Next Step?

At ML Mortgage, we’re here to help you make informed decisions with confidence. Whether you’re looking to buy, refinance, or simply explore your options, our team of experts is just a conversation away.

Contact us today to learn more about how real estate can help you build long-term financial security.